- Gambling Losses Tax Deduction 2018 Income Tax

- Gambling Losses Tax Deductible 2018

- Gambling Losses Tax Deduction 2018 Federal Taxes

- Gambling Losses Tax Deduction 2018 Filing

Solved: Are gambling losses deductible for tax year 2018? I keep reading different articles and now I am not sure. But for tax years 2018 through 2025 (or longer if Tax Reform 2.0 is enacted; it cleared the House this morning, but odds are against it making it through the Senate), the main miscellaneous expenses deduction is no longer available.

There are laws require that you declare your winnings in games including gambling as part of your income. But what about the losses? How do you account for the losses you made in gambling when it comes to tax filing?

It wouldn't be fair to be taxed for the winnings and not account for the losses. Gambling after all is like running a business but with considerably lower chances for success. It's easier making money by investing in a business compared to spending money on slots, dice, poker, or baccarat.

Based on data from H2 Gambling Capital, as reported on The Economist, global gambling losses in 2016 amounted to $385 billion with Australia topping the list of countries with the highest losses. By the way, loss here refers to the losses of players or the gains of gambling operators.

Source: The Economist, citing data from H2 Gambling Capital (website screenshot, fair use)

Tax Significance of Casinos, Online Casinos in Particular All star lanes casino poker rooms.

It's worth discussing the idea of tax on casino winnings mainly because online gambling is something common nowadays. Based on numbers from Statista, the online gaming market will have doubled in 2018 from its figure in 2009. The forecast is that it will become a $51.96 industry by 2018. A 2016 survey conducted by Nielsen Scarborough found that nearly 83 million Americans went to a casino in the past 12 months. That's a truly massive number representing gamblers in the US alone. However, it is expected that this number of gamblers who visit physical casinos is bound to shrink over time as more prefer to play at online casinos.

Online casinos provide convenience any gambler would surely appreciate. It allows playing without the limitations of location and time. It is a major advantage for modern gambling. Some may doubt its reliability, questioning the fairness of the games being offered, but with the help of systems like random number generation and provably fair testing, players are assured that the games they play are not being manipulated. There are companies or institutions that provide certifications for random number generation to vouch for the reliability of online casinos.

The games on online casinos have also been standardized to establish credibility. Most online casinos nowadays rent or buy their software from renowned gaming service providers like Playtech, Microgaming, Realtime Gaming, Amaya, Softswiss, and International Game Technology. The use of games from this well-known companies makes it easier for players to trust casinos as compared to offering completely new in-house developed games.

Moreover, online casinos have invested time, money, and effort in improving the looks and usability of their websites. Online casinos now look indubitably better than how they looked in the past. They also employ better technologies to ensure a smoother playing experience. Flash has slowly been abandoned in favor of HTML5. At present, it is estimated that only around 4.6% of all websites are still using Flash. The same dwindling numbers can be observed when it comes to Flash use in online casinos.

Online casinos have also been designed to be accessible across multiple devices, from desktops to laptops and mobiles including tablet computers and smartphones. Online gambling operators have made sure that their online casinos are easily accessible using mobile devices, which is obviously an acknowledgment of how big the number of mobile internet gamblers is. As of February 2017, it was estimated that mobile internet access (not including access through tablet computers) accounted for 49.73% of the total page views across different parts of the world.

It's not surprising that online casinos put emphasis on improving their looks, usability, accessibility, overall performance, and distinctiveness. They seek to provide a better casino experience that lets players enjoy quality games, snappy performance, reliability, intuitiveness, and the assurance that they will be paid of their winnings. 888 Casino, for example, has recently introduced a brand new sleek website design that makes it a one of a kind casino online.

Online gambling has come a long way and is being patronized by a growing number of people worldwide. While problem gambling is still the top issue associated with it, many are now recognizing that taxation of winnings is also an important issue to raise. After all, online casino winnings are still earnings worth subjecting to taxation. That's why it's worth discussing the tax implications of online casino winnings as well as the corresponding losses.

Deductible to a certain extent

The good news is that your gambling losses are actually deductible from your taxable income. Regardless of where you won and lost, be it in a traditional brick and mortar casino or in an online casino, you can deduct the losses you made from your taxable income. It does not matter if you gambled at a traditional brick and mortar casino where you made successive wins or you lost money at a dubious online casino. Your winnings and losses are supposed to be accounted for based on tax laws and regulations.

The main idea here is that you can subtract your gambling losses from the amount you won. Of course, you can't just directly deduct the amount of your losses from your tax due. It's similar to how you compute taxes for your business income. Your expenses and losses are deducted from your gross income first before multiplying the applicable tax rate to come up with the due amount of tax. The winnings are comparable to the gross income (in business) while the losses are comparable to the expenses and the actual losses of a business.

It's important to remember, though, that this deduction can only be allowed if you are qualified for itemized deductions. You need a detailed listing of your winnings and losses to come up with the net amount that will be subjected to the tax rate. These details are to be listed under Other Income and Other Miscellaneous Deductions sections of Form 1040. If you opt for the standard deduction, your gambling or casino losses will no longer be subtracted from your total taxable earnings.

Source: IRS

Itemized deduction vs standard deduction

Pine creek gorge slot canyon. Taxpayers automatically qualify for standard deduction except when the itemized deductions they claim are greater than the standard deduction. Tax authorities are responsible for deciding if you qualify for standard or itemized deduction. You will not be compelled to choose either standard or itemized deduction, though. If you find standardized deduction more convenient, you will not be forced to choose itemized deduction even if you qualify for it. Around a third of the taxpayers in the United States use itemized deduction.

Naturally, you will have to choose the deduction scheme that is more advantageous for you, the one that yields the lower tax due. You may want to do calculations, which shouldn't be difficult now since there are many tax computation tools online. Just do a search using the phrase 'tax calculator' and Google should be able to show you a number of online tax tools to help you get a good estimate of the tax you should be paying.

Bets are not expenses

Another important detail to remember here is that bets cannot be deducted as expenses. Gambling is not like running a business wherein you put out money for the acquisition of something (cost of goods sold) to be sold later on. In business, the cost of goods sold is deducted from the gross revenues, thereby reducing the amount (net income) that will be subjected to the appropriate income tax rate. This concept is not comparable to the bets placed when gambling.

Bets are personal expenses that cannot be deducted from the taxable income. Only the amounts for gambling winnings and losses are used for the computation of the net amount that will be added to your other income figures to come up with the final taxable income amount that will be subjected to the tax rate.

Documentation requirements

If you want to account for your gambling losses to calculate your tax, the Internal Revenue Service (IRS) needs you to maintain a comprehensive listing of your winnings and losses. Gambling winnings, by the way, include winnings from raffles, lotteries, sports betting, poker games, horse racing, canine racing, and various casino games online or offline. Income derived from any form of gambling ideally should be included.

Your record of winnings and losses have to be clearly detailed. The listings should include information on the date and type of gambling involved, the name and address of the establishment where you gambled, and the exact amount you won or lost. You will also be asked to list the names of the people you played with.

Moreover, you need to have supporting documents for the gambling winnings and losses you have in your record. These supporting documents include wagering tickets, form W-2G, form 5754, cancelled checks or credit records, and official receipts from the gambling establishment. You will be required to submit original documents.

Source: IRS

If your winnings and losses are from an online casino, you can ask for a win/loss statement from the online casino you played in. You may be required to submit other documents to verify the authenticity and accuracy of the details presented in the statement.

Limitations

Tax laws set a limit on the maximum amount that can be claimed as losses. Basically, you cannot claim losses that exceed your winnings. For instance, if you made accumulated winnings of $10,000, you cannot claim losses amounting to $10,001 or higher even if you actually lost more than you won. If you won $10,000 but your accumulated losses for a tax year amounting to $30,000, you cannot claim a net loss of $20,000. You cannot end up recording a negative number (net losses from gambling) that can then be deducted from your other taxable income. If this were to be allowed, it's would be like the government somewhat subsidizing the gambling activities of taxpayers.

In conclusion

It's important to emphasize that you cannot simply claim a net amount of winnings or losses. You need to have detailed records with all the information mentioned earlier. Gambling losses can help lower your tax due but it's unlikely going to be by a significant amount unless your finances largely consist of gambling winnings and/or losses.

Image: Pixabay.com

Welcome to a new day — a day that sports betting fans will remember for the rest of their lives.

On May 14, 2018, the Supreme Court struck down a federal law that effectively banned commercial sports betting in most all states. As a result of overturning PASPA, each state is allowed to authorize wagering on sports. One day soon you may be able to bet that the fifth pitch in the fifth inning of a baseball game will be a strike.

You can also bet that the money you win by betting sports is considered taxable income according to the IRS.

Here's what you need to know about sports betting taxes in 2018.

An overview of taxable sports betting income

First off, gambling income is almost always taxable income. According to the IRS, gambling winners must report all of their winnings – including cash and the fair market value of any item won, such as a raffle item — on their federal income tax returns.

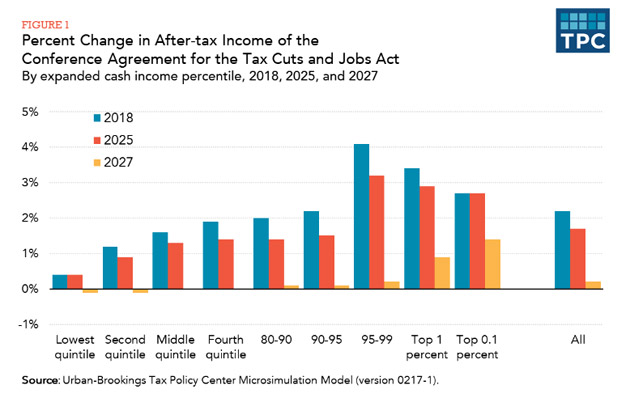

Casinos, as the payer of winnings, are required to withhold federal taxes from winnings above $5,000. New as part of the 2018 tax reform, that withholding rate is 24 percent, down from 25 percent in 2017. Depending on the total of your winnings, you may receive one or more Forms W-2G which reports the amount you won, including any tax withheld. All winnings reported on Form W-2G should be reported as other income on Form 1040, unless gambling is your trade or business.

Gambling Losses Tax Deduction 2018 Income Tax

Click here to get more details on Forms W-2G and 5754 for 2018.

Double down on deductions

The good news here is that you may deduct gambling losses if you plan on itemizing your deductions. But it's also worthy to note that as part of tax reform, the standard deduction nearly doubled for all taxpayers. That means it's likely that fewer taxpayers will have enough deductions to make itemizing an attractive option. According to tax law, you can only deduct your losses up to the amount of your total winnings. For example, if you won $2,000 on sports betting over the last year, you may only deduct $2,000 in losses if applicable. The same goes for any form of gambling.

If you plan on itemizing and deducting your losses, you must keep an accurate, detailed record of your wins and losses. You also need to provide sports betting tickets, receipts, or other statements that show the total of your winnings and losses. Your 'sports betting diary,' so to speak, needs to include items such as dates, the type of gambling activity, the establishment at which the bet was placed, and dollar amounts.

For any avid sports bettor, it's crucial to plan accordingly.

Professional gamblers: tax reform is here

If you pursue gambling regularly with the intention of making a profit, you are considered self-employed for tax purposes.

Under the new Tax Cuts and Jobs Act, those in the trade or business of gambling may no longer deduct non-wagering expenses, such as travel expenses or fees, to the extent those expenses exceed gambling income. Gambling losses include the actual wager and associated costs. Rather than claiming your winnings on sports betting as 'other income,' you need to file a Schedule C to report self-employment income. You can also deduct any costs of doing business on Schedule C as long as it's not more than your income. This new rule went into effect on Jan. 1, 2018.

Gambling industry jobs. Examples of deductions for a professional sports gambler include online or magazine subscriptions to insider content, a portion of your monthly internet costs (if you wager online), and travel expenses if you wager in-person at a casino. If you are a pro, then your gambling income is considered regular earned income and is taxed at your marginal income tax rate.

Gambling Losses Tax Deductible 2018

It wouldn't be fair to be taxed for the winnings and not account for the losses. Gambling after all is like running a business but with considerably lower chances for success. It's easier making money by investing in a business compared to spending money on slots, dice, poker, or baccarat.

Based on data from H2 Gambling Capital, as reported on The Economist, global gambling losses in 2016 amounted to $385 billion with Australia topping the list of countries with the highest losses. By the way, loss here refers to the losses of players or the gains of gambling operators.

Source: The Economist, citing data from H2 Gambling Capital (website screenshot, fair use)

Tax Significance of Casinos, Online Casinos in Particular All star lanes casino poker rooms.

It's worth discussing the idea of tax on casino winnings mainly because online gambling is something common nowadays. Based on numbers from Statista, the online gaming market will have doubled in 2018 from its figure in 2009. The forecast is that it will become a $51.96 industry by 2018. A 2016 survey conducted by Nielsen Scarborough found that nearly 83 million Americans went to a casino in the past 12 months. That's a truly massive number representing gamblers in the US alone. However, it is expected that this number of gamblers who visit physical casinos is bound to shrink over time as more prefer to play at online casinos.

Online casinos provide convenience any gambler would surely appreciate. It allows playing without the limitations of location and time. It is a major advantage for modern gambling. Some may doubt its reliability, questioning the fairness of the games being offered, but with the help of systems like random number generation and provably fair testing, players are assured that the games they play are not being manipulated. There are companies or institutions that provide certifications for random number generation to vouch for the reliability of online casinos.

The games on online casinos have also been standardized to establish credibility. Most online casinos nowadays rent or buy their software from renowned gaming service providers like Playtech, Microgaming, Realtime Gaming, Amaya, Softswiss, and International Game Technology. The use of games from this well-known companies makes it easier for players to trust casinos as compared to offering completely new in-house developed games.

Moreover, online casinos have invested time, money, and effort in improving the looks and usability of their websites. Online casinos now look indubitably better than how they looked in the past. They also employ better technologies to ensure a smoother playing experience. Flash has slowly been abandoned in favor of HTML5. At present, it is estimated that only around 4.6% of all websites are still using Flash. The same dwindling numbers can be observed when it comes to Flash use in online casinos.

Online casinos have also been designed to be accessible across multiple devices, from desktops to laptops and mobiles including tablet computers and smartphones. Online gambling operators have made sure that their online casinos are easily accessible using mobile devices, which is obviously an acknowledgment of how big the number of mobile internet gamblers is. As of February 2017, it was estimated that mobile internet access (not including access through tablet computers) accounted for 49.73% of the total page views across different parts of the world.

It's not surprising that online casinos put emphasis on improving their looks, usability, accessibility, overall performance, and distinctiveness. They seek to provide a better casino experience that lets players enjoy quality games, snappy performance, reliability, intuitiveness, and the assurance that they will be paid of their winnings. 888 Casino, for example, has recently introduced a brand new sleek website design that makes it a one of a kind casino online.

Online gambling has come a long way and is being patronized by a growing number of people worldwide. While problem gambling is still the top issue associated with it, many are now recognizing that taxation of winnings is also an important issue to raise. After all, online casino winnings are still earnings worth subjecting to taxation. That's why it's worth discussing the tax implications of online casino winnings as well as the corresponding losses.

Deductible to a certain extent

The good news is that your gambling losses are actually deductible from your taxable income. Regardless of where you won and lost, be it in a traditional brick and mortar casino or in an online casino, you can deduct the losses you made from your taxable income. It does not matter if you gambled at a traditional brick and mortar casino where you made successive wins or you lost money at a dubious online casino. Your winnings and losses are supposed to be accounted for based on tax laws and regulations.

The main idea here is that you can subtract your gambling losses from the amount you won. Of course, you can't just directly deduct the amount of your losses from your tax due. It's similar to how you compute taxes for your business income. Your expenses and losses are deducted from your gross income first before multiplying the applicable tax rate to come up with the due amount of tax. The winnings are comparable to the gross income (in business) while the losses are comparable to the expenses and the actual losses of a business.

It's important to remember, though, that this deduction can only be allowed if you are qualified for itemized deductions. You need a detailed listing of your winnings and losses to come up with the net amount that will be subjected to the tax rate. These details are to be listed under Other Income and Other Miscellaneous Deductions sections of Form 1040. If you opt for the standard deduction, your gambling or casino losses will no longer be subtracted from your total taxable earnings.

Source: IRS

Itemized deduction vs standard deduction

Pine creek gorge slot canyon. Taxpayers automatically qualify for standard deduction except when the itemized deductions they claim are greater than the standard deduction. Tax authorities are responsible for deciding if you qualify for standard or itemized deduction. You will not be compelled to choose either standard or itemized deduction, though. If you find standardized deduction more convenient, you will not be forced to choose itemized deduction even if you qualify for it. Around a third of the taxpayers in the United States use itemized deduction.

Naturally, you will have to choose the deduction scheme that is more advantageous for you, the one that yields the lower tax due. You may want to do calculations, which shouldn't be difficult now since there are many tax computation tools online. Just do a search using the phrase 'tax calculator' and Google should be able to show you a number of online tax tools to help you get a good estimate of the tax you should be paying.

Bets are not expenses

Another important detail to remember here is that bets cannot be deducted as expenses. Gambling is not like running a business wherein you put out money for the acquisition of something (cost of goods sold) to be sold later on. In business, the cost of goods sold is deducted from the gross revenues, thereby reducing the amount (net income) that will be subjected to the appropriate income tax rate. This concept is not comparable to the bets placed when gambling.

Bets are personal expenses that cannot be deducted from the taxable income. Only the amounts for gambling winnings and losses are used for the computation of the net amount that will be added to your other income figures to come up with the final taxable income amount that will be subjected to the tax rate.

Documentation requirements

If you want to account for your gambling losses to calculate your tax, the Internal Revenue Service (IRS) needs you to maintain a comprehensive listing of your winnings and losses. Gambling winnings, by the way, include winnings from raffles, lotteries, sports betting, poker games, horse racing, canine racing, and various casino games online or offline. Income derived from any form of gambling ideally should be included.

Your record of winnings and losses have to be clearly detailed. The listings should include information on the date and type of gambling involved, the name and address of the establishment where you gambled, and the exact amount you won or lost. You will also be asked to list the names of the people you played with.

Moreover, you need to have supporting documents for the gambling winnings and losses you have in your record. These supporting documents include wagering tickets, form W-2G, form 5754, cancelled checks or credit records, and official receipts from the gambling establishment. You will be required to submit original documents.

Source: IRS

If your winnings and losses are from an online casino, you can ask for a win/loss statement from the online casino you played in. You may be required to submit other documents to verify the authenticity and accuracy of the details presented in the statement.

Limitations

Tax laws set a limit on the maximum amount that can be claimed as losses. Basically, you cannot claim losses that exceed your winnings. For instance, if you made accumulated winnings of $10,000, you cannot claim losses amounting to $10,001 or higher even if you actually lost more than you won. If you won $10,000 but your accumulated losses for a tax year amounting to $30,000, you cannot claim a net loss of $20,000. You cannot end up recording a negative number (net losses from gambling) that can then be deducted from your other taxable income. If this were to be allowed, it's would be like the government somewhat subsidizing the gambling activities of taxpayers.

In conclusion

It's important to emphasize that you cannot simply claim a net amount of winnings or losses. You need to have detailed records with all the information mentioned earlier. Gambling losses can help lower your tax due but it's unlikely going to be by a significant amount unless your finances largely consist of gambling winnings and/or losses.

Image: Pixabay.com

Welcome to a new day — a day that sports betting fans will remember for the rest of their lives.

On May 14, 2018, the Supreme Court struck down a federal law that effectively banned commercial sports betting in most all states. As a result of overturning PASPA, each state is allowed to authorize wagering on sports. One day soon you may be able to bet that the fifth pitch in the fifth inning of a baseball game will be a strike.

You can also bet that the money you win by betting sports is considered taxable income according to the IRS.

Here's what you need to know about sports betting taxes in 2018.

An overview of taxable sports betting income

First off, gambling income is almost always taxable income. According to the IRS, gambling winners must report all of their winnings – including cash and the fair market value of any item won, such as a raffle item — on their federal income tax returns.

Casinos, as the payer of winnings, are required to withhold federal taxes from winnings above $5,000. New as part of the 2018 tax reform, that withholding rate is 24 percent, down from 25 percent in 2017. Depending on the total of your winnings, you may receive one or more Forms W-2G which reports the amount you won, including any tax withheld. All winnings reported on Form W-2G should be reported as other income on Form 1040, unless gambling is your trade or business.

Gambling Losses Tax Deduction 2018 Income Tax

Click here to get more details on Forms W-2G and 5754 for 2018.

Double down on deductions

The good news here is that you may deduct gambling losses if you plan on itemizing your deductions. But it's also worthy to note that as part of tax reform, the standard deduction nearly doubled for all taxpayers. That means it's likely that fewer taxpayers will have enough deductions to make itemizing an attractive option. According to tax law, you can only deduct your losses up to the amount of your total winnings. For example, if you won $2,000 on sports betting over the last year, you may only deduct $2,000 in losses if applicable. The same goes for any form of gambling.

If you plan on itemizing and deducting your losses, you must keep an accurate, detailed record of your wins and losses. You also need to provide sports betting tickets, receipts, or other statements that show the total of your winnings and losses. Your 'sports betting diary,' so to speak, needs to include items such as dates, the type of gambling activity, the establishment at which the bet was placed, and dollar amounts.

For any avid sports bettor, it's crucial to plan accordingly.

Professional gamblers: tax reform is here

If you pursue gambling regularly with the intention of making a profit, you are considered self-employed for tax purposes.

Under the new Tax Cuts and Jobs Act, those in the trade or business of gambling may no longer deduct non-wagering expenses, such as travel expenses or fees, to the extent those expenses exceed gambling income. Gambling losses include the actual wager and associated costs. Rather than claiming your winnings on sports betting as 'other income,' you need to file a Schedule C to report self-employment income. You can also deduct any costs of doing business on Schedule C as long as it's not more than your income. This new rule went into effect on Jan. 1, 2018.

Gambling industry jobs. Examples of deductions for a professional sports gambler include online or magazine subscriptions to insider content, a portion of your monthly internet costs (if you wager online), and travel expenses if you wager in-person at a casino. If you are a pro, then your gambling income is considered regular earned income and is taxed at your marginal income tax rate.

Gambling Losses Tax Deductible 2018

Gambling Losses Tax Deduction 2018 Federal Taxes

Keep in mind that TaxAct makes it simple for you to itemize and fill out the right tax forms to help ensure you maximize your deductions for the year.

Disclaimer: As a reminder, gambling addictions are a serious problem that need to be addressed as soon as possible. If you or someone you know has issues with gambling, please call 1-800-BETS OFF or seek help immediately.